Residents of the palmetto state can claim 25 percent of their solar costs as a tax credit and if you don t pay enough in taxes to get the full value of the credit in one year it.

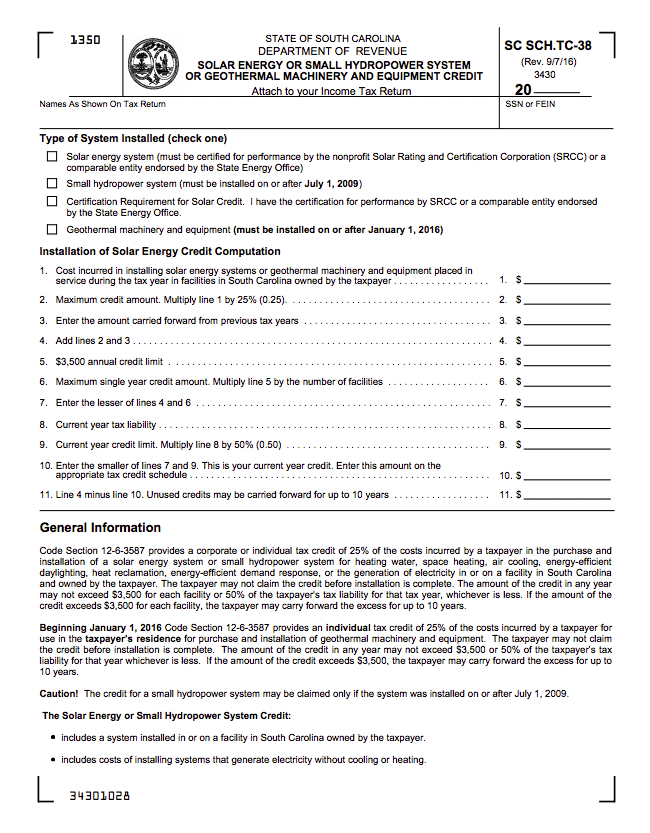

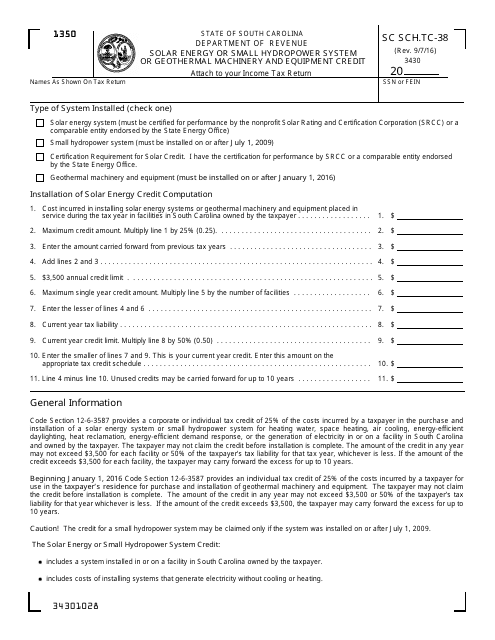

South carolina solar tax credit form.

South carolina department of revenue po box 125 columbia sc 29214 0825.

Taxcredits dor sc gov angel investor credit parental refundable credit and education donor nonrefundable credit.

The corresponding code is 038 solar energy or small hydropower system credit.

This law provides a tax credit of up to 25 percent on all eligible costs to a maximum of 3500 or 50 percent of a person s tax liability whichever amount is less when applied to the individual s yearly taxes.

In july 2009 south carolina passed its solar rebate tax incentive law to allow homeowners in the state to claim credits for any renewable energy systems that they installed in their homes.

For installing a solar energy system or small hydropower system in a south carolina facility tc 38.

A tax credit is an amount of money that can be used to offset your tax liability.

The largest credit that can be applied in a single year is 3500 or 50 of your state tax liability whichever is less.

South carolina solar energy tax credit cut the cost of installing solar on your home by a quarter with south carolina s state tax credit for solar energy.

General tax credit questions.

Credits are usually used to offset corporate income tax or individual income tax.